On April 20, SDG&E, along with other major utilities in the state, made our required filing with the California Public Utilities Commission (CPUC) seeking approval to update our rate of return (ROR) for investments made in electric and gas operations. The filing is formally called the cost of capital application.

If approved, our request will reduce SDG&E’s ROR and will not increase the monthly bill for the average residential customer. Our request for a lower rate of return reflects the company’s conscientious effort to balance the interests of our customers and the shareholders whose investments help ensure our region’s electric and gas infrastructure can be as reliable, safe, and clean as possible.

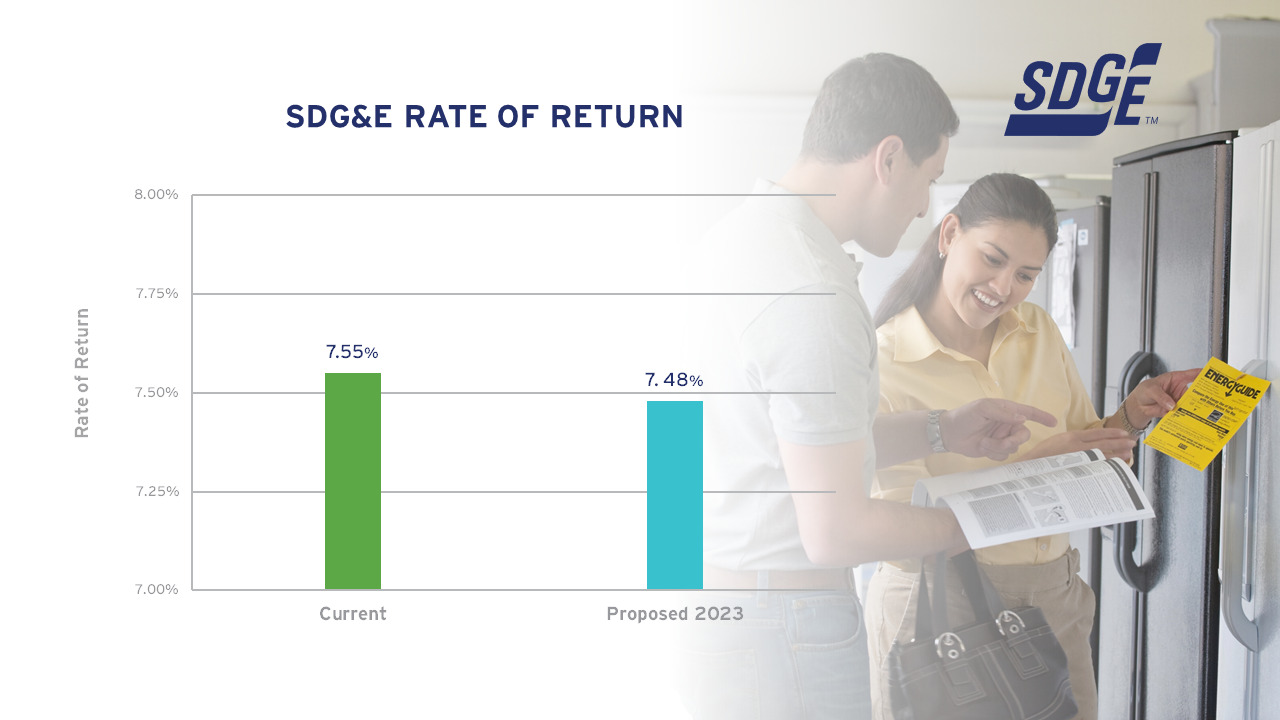

SDG&E is seeking approval for a rate of return of 7.48%, which represents a modest decrease from our current, authorized ROR of 7.55%. SDG&E’s proposed rate of return for 2023 is the lowest among the major utilities in California. The ROR is never guaranteed. It is merely an opportunity to earn that return.

Our proposed rate of return will enable SDG&E to raise the funds needed to build and maintain the infrastructure of the future – one that minimizes wildfire risks and builds on our unmatched record of reliability, all while meeting ambitious local and statewide climate and environmental goals. Additionally, it will also help reduce future borrowing costs to customers as a result of higher credit ratings.

Cost of Capital Proceeding is Open and Transparent

Utilities’ cost of capital proposals are thoroughly scrutinized by the CPUC and a variety of stakeholders, including consumer advocates, before the CUPC authorizes an acceptable rate of return.

SDG&E proposes to implement the 2023 rate of return effective Jan. 1, 2023.

Questions and Answers

What is the cost of capital?

To build, operate and maintain the infrastructure – such as poles, wires, pipes and substations – needed to deliver reliable, safe, and clean electricity and natural gas to customers, we must raise funds by either issuing debt or raising equity (selling stocks). The cost of debt is the cost to raise capital through borrowing, while the cost of equity is the cost of obtaining and retaining capital from investors. Taken together, these costs are known as the cost of capital.

If SDG&E’s cost of capital application is approved by the California Public Utilities Commission, how would it impact monthly bills?

If approved, our request would reduce SDG&E’s ROR and will not increase the monthly bill for the average residential customer.

What rate of return is SDG&E seeking?

SDG&E is seeking approval for a rate of return of 7.48%, which represents a modest decrease from our current, authorized ROR of 7.55%. The ROR is never guaranteed. It is merely an opportunity to earn that return.

How does SDG&E’s proposed rate of return compare to what other major utilities in California are seeking?

SDG&E’s proposed rate of return for 2023 is the lowest among the major utilities in California.